As we approach the end of the year, it’s a great time to assess your financial situation and make strategic moves to prepare for the year ahead. According to a recent report by Deloitte, total consumer debt in the U.S. reached a record high of $17.7 trillion in Q2 2024, and many Americans have already exhausted their pandemic-era savings. With the economy facing uncertainties heading into 2025, now is the perfect time to take charge of your finances and set yourself up for success in the upcoming year.

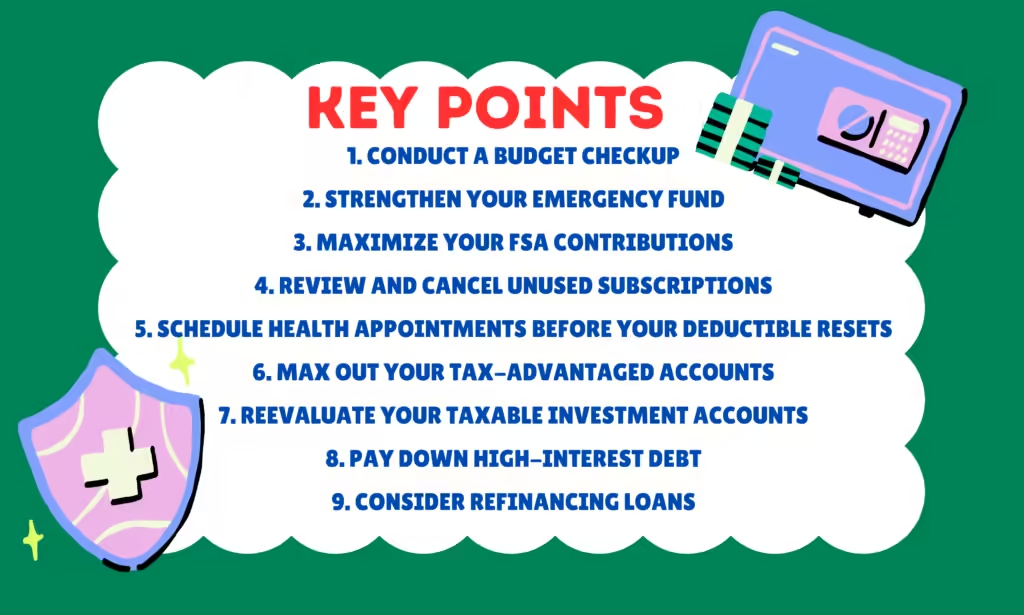

Here are nine important financial steps to consider before the year ends:

1. Conduct a Budget Checkup

A well-established budget is essential, but it should remain flexible to reflect any changes in your financial situation. Review your monthly spending against your expected expenses for the year.

- Did you spend more, less, or about the same as planned?

- If you overspent, consider revising your budget for 2025 by cutting unnecessary expenses or finding ways to increase your income.

- If you underspent, consider using the surplus to boost savings or make additional contributions to your retirement accounts.

A budget checkup will help you gain clarity on your financial habits and allow you to adjust for the coming year.

2. Strengthen Your Emergency Fund

One of the most crucial steps in ensuring financial stability is maintaining an emergency fund.

Why is this important? Without an emergency fund, you might have to rely on high-interest credit cards or loans in the event of an unexpected expense like job loss, medical emergencies, or urgent home repairs. Experts typically recommend setting aside 3 to 6 months’ worth of living expenses in a liquid account that you can access when needed.

If you don’t yet have an emergency fund or need to build it up, review your current savings and create a plan to contribute regularly. Consider using a high-yield savings account to grow your emergency fund more efficiently.

3. Maximize Your FSA Contributions

With a Flexible Spending Account (FSA), you can allocate pre-tax funds for medical costs. The maximum contribution for 2024 is $3,300 per employer, and any unused funds are typically forfeited at the end of the year.

To avoid losing this money, take stock of your remaining FSA balance and use it before the year’s end. Common qualifying expenses include medical co-pays, prescription medications, and certain over-the-counter products. Be sure to check with your employer for specific details on eligible expenses and any carryover options.

4. Review and Cancel Unused Subscriptions

Many people are unaware of how much they’re spending on recurring subscriptions. According to C&R Research, the average consumer spends around $219 per month on subscriptions, though they estimate spending only $86. This “subscription creep” can cost you thousands of dollars each year without you realizing it.

Take time to review your bank and credit card statements for any subscriptions you no longer use, such as streaming services, fitness apps, or magazine subscriptions. Cancel those you don’t need or use. You can also use a service like Rocket Money to help track and manage recurring payments more easily.

5. Schedule Health Appointments Before Your Deductible Resets

If you’ve already met your health insurance deductible for the year, take advantage of it before it resets in January. Schedule any medical appointments you may have been putting off, as you’ll pay less out of pocket for services now than you will after your deductible resets.

By planning ahead and using your benefits before the new year, you can reduce your healthcare costs and ensure that you get the care you need.

6. Max Out Your Tax-Advantaged Accounts

Tax-advantaged accounts such as 401(k)s, IRAs, and Health Savings Accounts (HSAs) offer significant benefits, including reducing your taxable income for the year. Contributions to these accounts can lower your tax bill and increase your retirement savings.

- 401(k)s and IRAs: The contribution limits for 2024 are $22,500 for 401(k)s (or $30,000 if you’re 50 or older) and $6,500 for IRAs (or $7,500 if you’re 50 or older).

- HSAs: The 2024 contribution limits for a family are $8,300, and for an individual, it’s $3,850.

While you have until April 15, 2025, to contribute to your tax-advantaged accounts for the 2024 tax year, it’s wise to aim to max out contributions before the year ends, if possible. If your budget doesn’t allow for maxing out, at least contribute enough to capture any employer match on your 401(k).

7. Reevaluate Your Taxable Investment Accounts

While tax-advantaged accounts are crucial for long-term wealth building, taxable brokerage accounts also offer flexibility and benefits. These accounts allow you to withdraw funds without penalties, and you have more control over your investment choices.

Perform a year-end review of your taxable accounts to ensure your portfolio is aligned with your financial goals. Consider rebalancing your investments to maintain your target asset allocation. Additionally, you may want to engage in tax-loss harvesting—selling underperforming investments to offset capital gains taxes.

8. Pay Down High-Interest Debt

High-interest debt, such as credit card balances, can take a significant toll on your financial health. Reducing or eliminating this debt before the new year can help you enter 2025 with a cleaner financial slate.

Even if you can’t pay off the entire balance, consider making extra payments to reduce your outstanding debt. For example, paying an extra $50 or $100 a month can lower your credit card balance faster, saving you money on interest in the long run.

9. Consider Refinancing Loans

Interest rates have been fluctuating throughout 2024, and recent cuts in the federal funds rate mean that interest rates on loans may be lower than when you initially took out a large loan or mortgage.

If you’re paying high-interest rates on loans such as your mortgage or car loan, now might be the time to explore refinancing options. Refinancing could reduce your monthly payments or shorten your loan term, saving you money in the long run. However, be mindful of fees and costs associated with refinancing, and ensure that the savings outweigh the potential expenses.

Conclusion

Taking proactive steps to improve your financial situation before the end of the year can have a lasting impact on your financial health in 2025. Whether it’s revisiting your budget, building up your emergency fund, or taking advantage of tax-advantaged accounts, these nine strategies will help set you up for success. By addressing these tasks now, you can enter the new year with greater confidence and financial stability.

more related click here